Our team advises Italian and non-Italian clients on corporate policy-making and planning of the most appropriate organisational and operational measures to manage the risk of money laundering, by setting up a proper structure of controls (compliance) and the adequate monitoring of this risk.

Our primary aim is to prevent the unlawful use of the clients as a vehicle for money laundering or terrorist financing and to protect them against any liability action and/or disciplinary proceeding, personal and/or on behalf of the company, arising from industry laws and regulations.

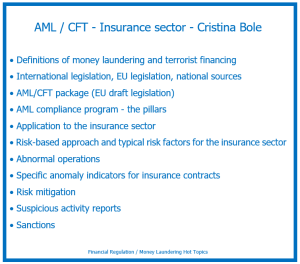

Cristina Bole Discusses about the Legal and Regulatory Framework in the EU to Prevent Money Laundering in Insurance – NYSBA Webinar